The Investment Promotions department is at the heart of Invest SVG – St. Vincent and the Grenadines’ governmental investment agency. This department is charged with attracting Foreign Direct Investment (FDI) that is sustainable and fits in with the national economic development objectives of the Government of SVG.

Investment Promotion Services

Investment Promotions’ talented and enthusiastic staff carry out this mandate through the execution of specific marketing objectives that span seven sectors. Namely: Tourism Development, International Financial Services, Creative Industries, Agro-Processing, Renewable Energy, Light Manufacturing and Information and Communication Technology (ICT).

Tourism Development

An exotic blend of leisure and business, St.Vincent and the Grenadines is a multi-island destination with 32 islands and cays – perfect for leisure and enormous business opportunity. The destination is new and unspoiled; an excellent location for investments that are outside the ordinary, and it is environmentally focused. The world is looking for something new – the world is looking for St.Vincent and the Grenadines!

International Financial Services

As a safe, White-listed and well-regulated jurisdiction, St. Vincent and the Grenadines’ International Financial Services sector is regulated by the International Financial Services Authority (FSA). It is managed by a regulatory body with legal experience spanning over 40 years, and is serviced by efficient professionals. The jurisdiction has a cost comparative advantage that exceeds others, and boasts a range of World Class products.

Learn more about the FSA via their website here.

Learn more about the FSA via their website here.

Agro-Processing

The cultivation and export of agricultural crops, especially bananas, continues to be of critical importance to the economy of St. Vincent and the Grenadines despite its steady decline on the world market. Although changes in the banana marketing regime resulted in a loss of international market share and a significant reduction in price to the farmer, it is still the leading crop in St. Vincent with over 62 million lbs yield in 2008.

In lieu of the on-going challenges affecting the growth of banana export, the government has responded by focusing on diversifying the productive base of the economy with particular emphasis on agro-processing. At present, the Lauders Agro-Processers is leading the way in this sector preparing vacuum packed fruits and vegetables for local, regional and international markets.

There is also the Orange Hill Agro-Processing Laboratory which is jointly operated by Taiwan Technical Mission and the Ministry of Agriculture, Forestry and Fisheries. The major focal point of the laboratory is to diversify the agriculture items into different form of processed products. For the past few years, it has been in the production of dehydrated fruit (jujube, carambola, sweet potato), concentrated juice (passion fruit, lemonade, ginger), chips (green banana, sweet potato and bread fruit), ground spices (hot pepper and ginger) and ice cream (passion fruit and mango). These products with an annual production capacity of about two thousand pounds (2,000) satisfy the local market and the revenues reinvested into the fund for sustainability.

Some of the investment opportunities currently available are the manufacture of fruit juices, fruit based beverages, jams, jellies and marmalades using locally available fruits, and the production of desiccated coconut, coconut cream and coconut milk. Foreign Direct Investment into the manufacturing and agro-processing sectors has strong potential for any serious investor, and would reap mutual benefit for both any investor and the national economy.

Significant interest has been generated in the benefits of food processing in St. Vincent and the Grenadines not only as a means of exploiting the rich food resource but also as a means of improving nutritional status. A number of entrepreneurs have continued to progress toward commercialisation and there is now greater use of a number of local crops. Agro-processing utilizing root crops and fruit tree crops is being recognized as having good potentials for development to facilitate import substitution and for exports, and will also support food security.

The established policy objectives of the Government of St. Vincent and the Grenadines are to maximize the economic potential of the country in an effort to deliver higher and sustainable growth, eradicate poverty and reduce unemployment, and improve the general welfare of the population. The farmers, by reducing waste of fruit and vegetables, will not only realize revenue but also learn how to meet global market demand while at the same time generate added benefits to the food and the packaging industry.

Regulations & Incentives

The following incentives are granted in accordance with the Fiscal Incentives Act No. 5 of 1982 (as amended by Act No. 16 of 1991) by the government for the establishment and development of the manufacturing and processing industries.

Industrial Investment Incentives

Fiscal Incentives may be granted to an ‘Approved Enterprise. Such an enterprise must be engaged in the manufacturing of or must be about to embark on the establishment of an industry in the State to manufacture an ‘Approved Product’.

Upon receipt of an application for the establishment of an industry or where the application is received from an enterprise that is manufacturing the product, Cabinet may declare such an enterprise an ‘Approved Enterprise’. Also, Cabinet may, by notified order, declare any product an ‘Approved Product’.

For detailed information please view the SVG Investment Guide Here

Renewable Energy

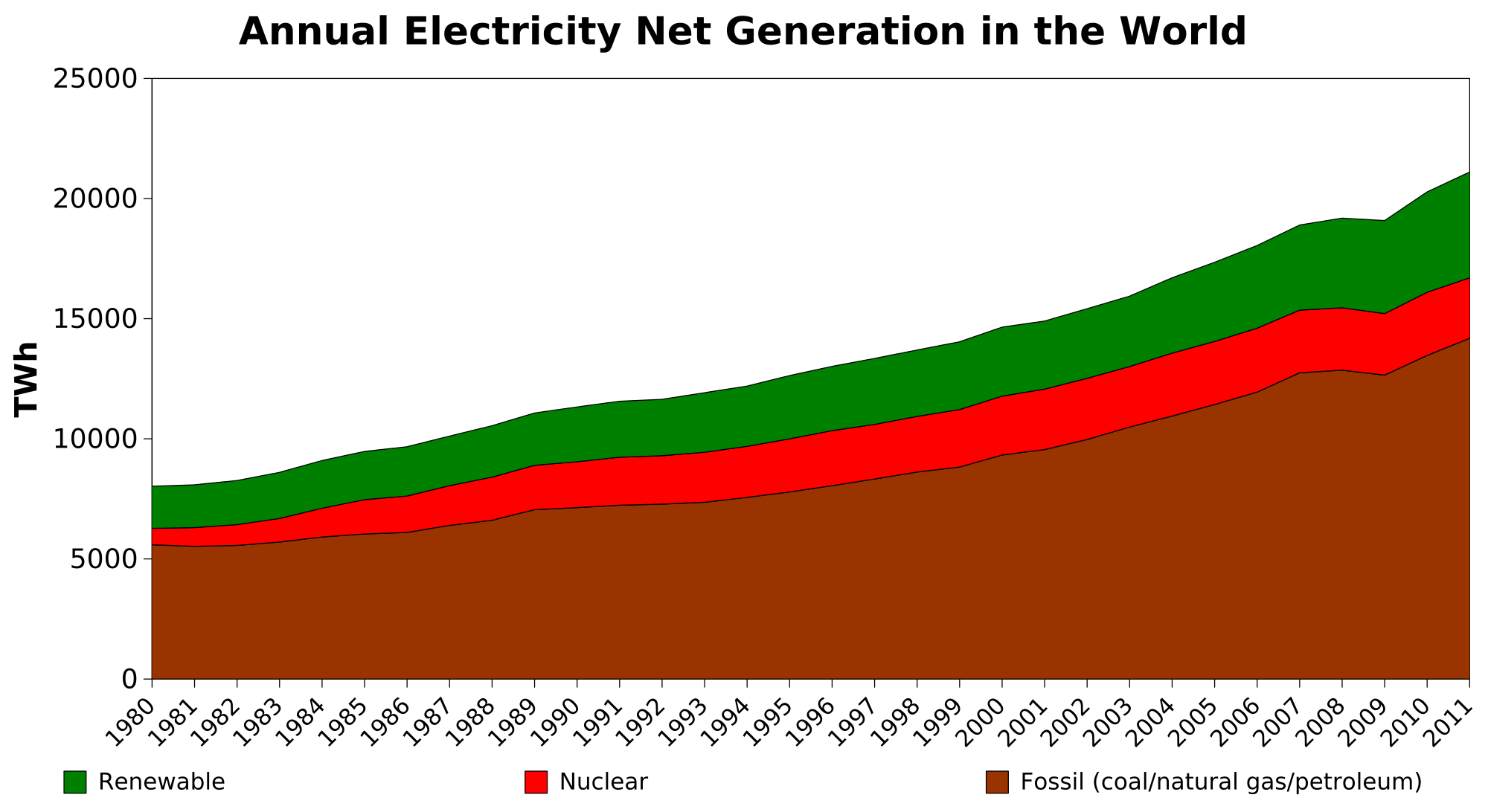

The Government of Saint Vincent & the Grenadines, in an effort to minimize the country’s dependence on the importation of fossil fuels have shifted its energy policies to encourage the investment of renewable energy.

St. Vincent and the Grenadines (SVG) is a multi-island state comprising the main island of St. Vincent and a collection of inhabited and uninhabited islets and cays making up the Grenadines.

The islands are home to a population of 103,000 people and cover a land area of 389 square kilometres. Aside from the main island of St. Vincent, other Grenadine islands with significant energy demands include the islands of Bequia, Union and Canouan. The country is almost completely dependent on imported petroleum products such as diesel (transport and electricity generation), gasoline (for transport), kerosene (cooking) and butane/LPG (cooking and water heating).

In 2010, the Government’s Cabinet adopted an Energy Action Plan (EAP) to be implemented within the framework of the approved National Energy Policy. The EAP outlines a number of renewable energy and energy efficiency milestones to be achieved through specific actions to be accomplished within short, medium and long-term time frames. One of these milestones is to reduce the projected consumption of fossil fuel in the transport sector by 15% by 2020.

SVG is heavily dependent on imported petroleum products for electricity generation, transportation, cooking, and other energy requirements. It has an energy mix with more than 83% petroleum base and about 17% hydro power with emerging contribution from solar PV and geothermal. The country is endowed with other potential indigenous sources including geothermal, solar thermal, wind and biomass.

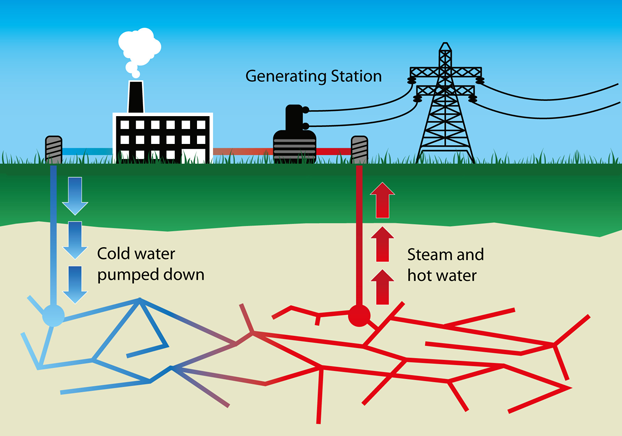

St. Vincent and the Grenadines is an excellent choice for the development of geothermal energy which will increase energy security and sustainability. The Government has embarked on a geothermal development project that will in its first stages generate 15MW geothermal power. The development of geothermal energy therefore, is expected to facilitate a more efficient electricity market, and underpin a more enabling business environment. Geothermal energy is a significantly cheaper and a cleaner source of energy that has a much lower environmental impact than conventional energy technologies. Should our potential be realized, this will have significant and positive impact on our fledgling manufacturing sector and give a competitive edge to many small and medium sized enterprises. It will also afford a unique opportunity to attract new manufacturing enterprises that depend heavily on energy input. This sector is very promising and will become substantially more so as new opportunities are explored.

Through Government co-funding and grants from different organizations the following projects have been implemented:

- Installation of 200 solar PV panels generating 50KW at the Belle Isle Correctional Facility.

- Installation of 230kw of grid-tied, ground mounted solar power system at the newly constructed Argyle International Airport.

- Installation and construction of a 5kw grid-tied, solar photovoltaic system and an electric car charging port at the Administrative Building to demonstrate the viability of electric vehicle technology in SVG.

- Installation of a 10kw grid-tied, solar photovoltaic system to offset the electricity consumption of the Government’s Administrative Building.

- 10KW solar PV system at VINLEC’s engineering complex

- 75.9 kW PV system at the reverse osmosis (RO) desalination plant on Bequia Island that was commissioned in October 2011 to supply 170,000 kWh annually to the plant.

SOLAR

Saint Vincent, given its location in the Caribbean, receives an abundance of sunshine and is therefore in a position to generate electricity using photovoltaic technology. SVG has a global horizontal irradiance (GHI) that averages 5.8 kWh/m2/day throughout its low-lying lands, sufficient solar resource for flat-panel PV and solar hot water systems. SVG has, since 2011, developed initiatives utilizing solar energy

HYDRO

Among CARICOM states, St. Vincent is the only island in the group with renewable hydro resources that are exploited for electricity generation. This hydropower generation capability has enabled SVG to have an energy mix of more than 83% petroleum base and about 17% hydropower.

The hydropower plants on St. Vincent are distributed among three plants with an available plant capacity is 5.2 MW during the rainy season, while the output drops to around 2 MW during the dry period. Since hydropower is not available at full scale year-round with some diesel plants working only as back-up systems, firm capacity is far lower and reached only approximately 31 MW by the end of 2005. For St. Vincent alone, firm capacity was 26.1 MW, while peak demand was 18.6 MW in 2005 leaving sufficient reserve margin during most of the year.

GEO-THERMAL

The Soufriere stratovolcano dominates the northern half of the island of St. Vincent and is one of the many active volcanoes in the Lesser Antilles arc. Activity of this volcano extends back at least 600 thousand years (Briden et al., 1979).

St. Vincent, like hundreds of other geologically active islands worldwide with untapped geothermal energy potential, is quite remote with difficult and geo-hazardous terrain, as well as being endowed with unspoiled natural beauty that supports a growing tourism industry. The Government of St. Vincent and the Grenadines in partnership with Reykjavik Geothermal and Emera Caribbean Incorporated (Collectively “St. Vincent Geothermal Company Limited” and in the first stages for the construction of a 15MW geothermal power development on the southern slopes of the La Soufriere volcano.

WIND

The development of wind energy in SVG has been studied by VINLEC since 2005 with the assistance of the GIZ. The studies focused on wind resource assessments at Brighton and later at Ribishi Point on the southern side of St. Vincent. While wind measurements at Brighton have been recently discontinued, VINLEC continued to pursue an opportunity for establishing 3.6 MW of wind power at Ribishi Point and have completed environmental and social impact assessment studies.

However, progress was halted due to issues raised by the East Caribbean Civil Aviation Authority (ECCAA) regarding the proximity of the wind farm to the new airport at Argyle. There are options currently being explored to include a scaling down of the project to utilize smaller and less obstructive wind turbines. Wind energy development has also been studied on some of the small Grenadines islands, especially Mayreau (250 inhabitants), which showed encouraging results.

It is envisaged that through these projects there will be a greater share of renewable energy (RE) in the energy mix therefore strengthening of the country’s clean energy policy framework including the streamlining of processes for RE investment approvals; increasing the capacities of appropriate institutions and individuals to support clean energy developments in SVG; and mobilizing investments for RE demonstration projects utilizing Renewable Energy resources for electricity generation.

Light Manufacturing

The Light Manufacturing sector is another avenue through which the export development strategy can be boosted.

Export of products will be facilitated through the existing ports at Kingstown and Campden Park. Additionally, the construction of the new jet port in Argyle compliments the existing air facilities at the other smaller airports on the Grenadine Islands, thereby enhancing the export capabilities of the country. Furthermore, the Government is examining the possibility of establishing a Free Port/Zone at the Campden Park Container Port.

The Light Manufacturing sector currently supports electronic assemblies and the production of custom made and high-end furnishings. There is a wealth of resources available for upscale children’s dresses. There are two industrial estates, one of which will be developed specifically for information and communications based activity.

Currently the country has investment in the following areas of manufacturing:

- Animal Feed

- Blocks (for construction)

- Brewing of alcoholic and non-alcoholic beverages

- Distilling

- Flour milling

- Food processing

- Furniture

- Galvanised products

- Garments

- Glass products

- Handicraft

- Jewellery

- Pasta production

- Packaging

- Plastics

- Rice milling

- Soft drinks

- Wine making

St.Vincent and the Grenadines, through the National Properties Ltd, can provide customised as well as standard factory shells of 6,000, 10,000 and 20,000 feet. The shells are already fitted with electrical and plumbing connections.

Regulations and Incentives

The following incentives are granted in accordance with the Fiscal Incentives Act No. 5 of 1982 (as amended by Act No. 16 of 1991) by the government for the establishment and development of the manufacturing and processing industries.

Industrial Investment Incentives

Fiscal Incentives may be granted to an ‘Approved Enterprise. Such an enterprise must be engaged in the manufacturing of or must be about to embark on the establishment of an industry in the State to manufacture an ‘Approved product’.

Upon receipt of an application for the establishment of an industry or where the application is received from an enterprise that is manufacturing the product, Cabinet may declare such an enterprise an ‘Approved Enterprise’. Also, Cabinet may, by notified order, declare any product an ‘Approved Product’.

An application for Fiscal Incentives must contain the following information:

| The locality or proposed locality of the factory | |

| The construction day (must not be later than 12 months after the date of granting of the application). | |

| The production day (must not be later than 18 months from the construction day) | |

| The approved product | |

| All information relevant to the determination of the “local value added”. (See below) |

In accordance with the Fiscal Incentives Act, 5 types of manufacturing and processing enterprises can qualify for a tax holiday. The length of the tax holiday for the first 3 types depends on, among other things, the amount of local value added to the finished product(s). The fourth type is called an Enclave Industry, meaning that it produces exclusively for export to extra-regional markets. Categories of enterprises and tax holiday allowable are as follows:

Category Tax Holiday Period

Group I Enterprise 15 years

Group II Enterprise 12 years

Group III Enterprise 10 years

Enclave Enterprise 15 years

Notwithstanding the above, the local value added content (expressed as a percentage of sales of an approved product) is first estimated, as shown below, for enterprises in Group I, II and III.

Category Local Value Added Content

Group I Enterprise 50% or more

Group II Enterprise 25% or more but less than 50%

Group III Enterprise 10% or more but less than 25%

“Local value added” means the amount by which total sales of an approved product over a period of twelve months exceeds the aggregate of the following:

1. The value of imported raw materials, contents of components and parts, fuel and services;

2. Wages, salaries paid to non-nationals of CARICOM;

3. Profits distributed or remitted directly to persons who are not resident in a member state;

4. Interest, management charges and other income payments accruing directly to persons who are not resident in a member state and

5. Depreciation on imported plant and machinery and equipment.

Additionally, exports of approved products to Guyana, Jamaica and Trinidad and Tobago ONLY are eligible for an ‘Export Allowance’ under the Act. Such an allowance, however, is confined to a period not exceeding 5 years after the expiration of the tax holiday period. The Export Allowance is calculated as follows:

Export sales (as a % of total sales) Rebate of Income Tax (as a % of income tax on export sales)

10 but under 21 25%

21 but under 41 35%

41 but under 61 25%

61 and over 50%

Tax holiday is also granted to capital-intensive industry, where initial capital invested is not less than ECD$25 million.

Other benefits under the Act include:

| Duty-free importation of plant, equipment, machinery, spare parts, raw materials or components for a period equivalent to the tax holiday granted (Category I, II, III). | |

| Exemption of income tax on dividends paid to shareholders. | |

| Net losses set-off in computing the profits taxable for the 5 years following the tax holiday period. |

Export Development Incentives

Enterprises benefiting from tax and duty concessions under the Fiscal Incentives Act are accorded partial relief from income tax chargeable on the profits earned from exports. This provision becomes operative as soon as the enterprise’s tax holiday expires and lasts for 5 years. The percentage allowance is the same as the rates of Rebate of Income, as above.

Other benefits under the Export Development Incentives include:

| Repatriation of profits | |

| Exemption from capital gains tax. | |

| Working capital advances for the purchase of inputs and raw materials under the Export Credit Guarantee Scheme (ECGS). |

Assistance to Small/Medium Size Manufacturers

Under the Industrial Incentive Credit Programme facilitated through the Ministry of Telecommunications, Technology and Industry, small to medium size manufacturers can benefit from consumption tax relief as well as an entitlement to 90% write-off of the outstanding arrears of local consumption tax. The Industrial Incentive Credit is not an amount paid in cash, but is an allowance that can be deducted against future consumption tax payable. This credit is granted annually.

Three sub-sectors were targeted to benefit initially from the Industrial Incentive Credit.

These are:

| Agro-processing and pasta | |

| Furniture | |

| Ice Cream |

Access to this incentive credit is not automatic. Manufacturers would be required to:

- Submit completed application form and audited financial statements

- Have annual sales of up to EC$250,000 (qualifying firms will receive a credit equivalent to 100% of the local consumption tax payable on the first EC$250,000 in annual sales). Firms with annual sales of EC$50,000 or less would not be required to provide financial statements, but must provided some form of evidence of its operations, for example, tax returns

- Fulfil all their statutory obligations, such as payment to the NIS and records of PAYE deduction for workers.

Creative Industry

SVG’s Creative Industry is one of the key income generators for the local economy. Sub-sectors within this industry include:

- Music (including recording, live performance and music publishing)

- Film and Television (including on-location productions)

- Book and Magazine Publishing

- Performing Arts

- Visual Arts

- Festivals and Cultural Tourism

- Fashion

- Collective Management of copyright and related rights

Worldwide, the creative industries are projected to account for more than seven per cent of the world’s GDP, and the sector is forecast to grow at a rate of 10 per cent annually. Soca and Ragga Soca genres of music, Fashion and Film have placed St Vincent and the Grenadines on the international stage; and continue to boost other sectors such as tourism.

Film

St. Vincent and the Grenadines possesses a natural landscape and seascape, and is one of the last unspoilt locations in the world. Its many well preserved historical sites and buildings, and it competitive pricing make it ideal for epic/historical films. It is the recognition of such qualities that made St. Vincent and the Grenadines the natural choice of Disney for the blockbuster movie ‘Pirates of the Caribbean’.

Music

Music and entertainment is currently centered on the annual Carnival ‘Vincy Mas’, but with the crossover appeal of Caribbean Soca into the musical mainstream, investment opportunities exist for producing and marketing this increasingly popular music. Opportunities also exist for partnering with the Government in strengthening the link between Tourism and entertainment; particularly in the development of the unique and already popular annual festivals such as Nine Mornings and the Blues Festivals held on the Grenadines islands of Mustique and Bequia.

Fashion

The global fashion industry is expanding, and goes beyond haute couture/runway fashion to prêt-à-porter (ready to wear) and trendy, urban designs. Nowadays, the industry covers a wide range of fashionable products, including perfume, jewelry and accessories.

Today, the originality of ethnic textiles combined with the eccentricity and diversity of works by fashion designers from developing countries is conquering world markets. The organization of Fashion Weeks throughout the Caribbean region is facilitating the promotion of designers, stylists and models to the rest of the world. In this respect, developing economies are being called upon to better explore trade opportunities in world markets in light of the new scenario of liberalized markets for textiles and clothing post Multi-fibre Agreement.